6 Ways To Complete The Penny Savings Challenge (Includes Free 1p Savings Challenge Templates, Interactive Spreadsheets and Interactive Google Sheets)

We've all heard the term a penny for your thoughts, but how about a penny for your savings?

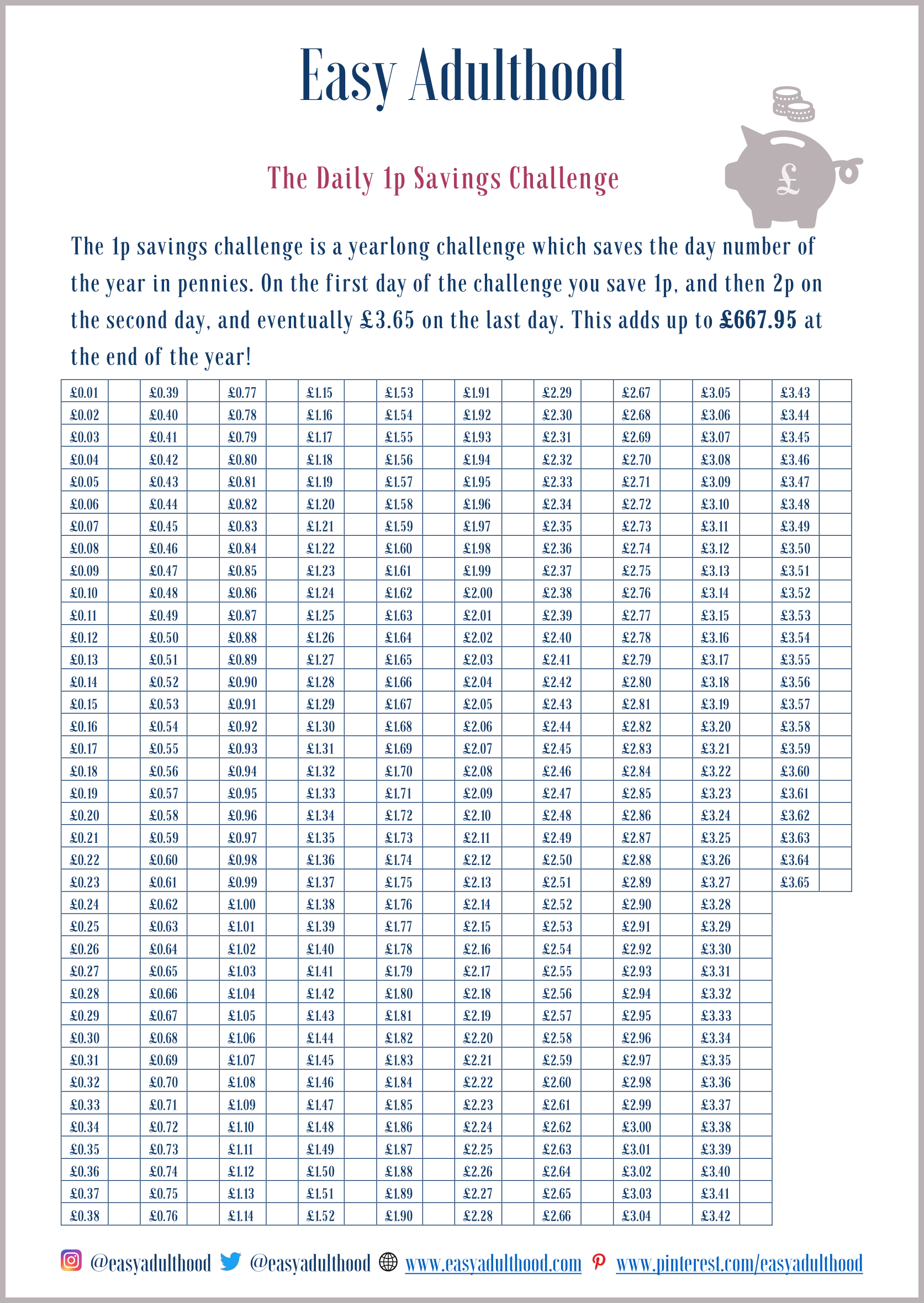

The penny savings challenge is a great way to save money, especially for beginner savers. It's a yearlong challenge which looks at the day number of the year and saves that amount in pennies. On the first day of the challenge you save 1p, and then 2p on the second day, and eventually £3.65 on the last day. This adds up to £667.95 at the end of the year! This challenge proves that saving ‘little and often’ really adds up over time.

Some people like to start the challenge in January as a new years financial resolution, but you can start the challenge at any point in the year. You can also complete the challenge in reverse order, by saving the largest amount first.

Here are 6 ways to complete The Penny Savings Challenge

In the tables below, we display 6 ways to approach the 1p savings challenge, you can download a free PDF template of the tables to track your progress. We also provide a free interactive Spreadsheet and a free interactive Google Sheet for each approach. The Spreadsheets and Google Sheets contain a doughnut chart that provides a visual representation of how close you are to reaching the target of £667.95.

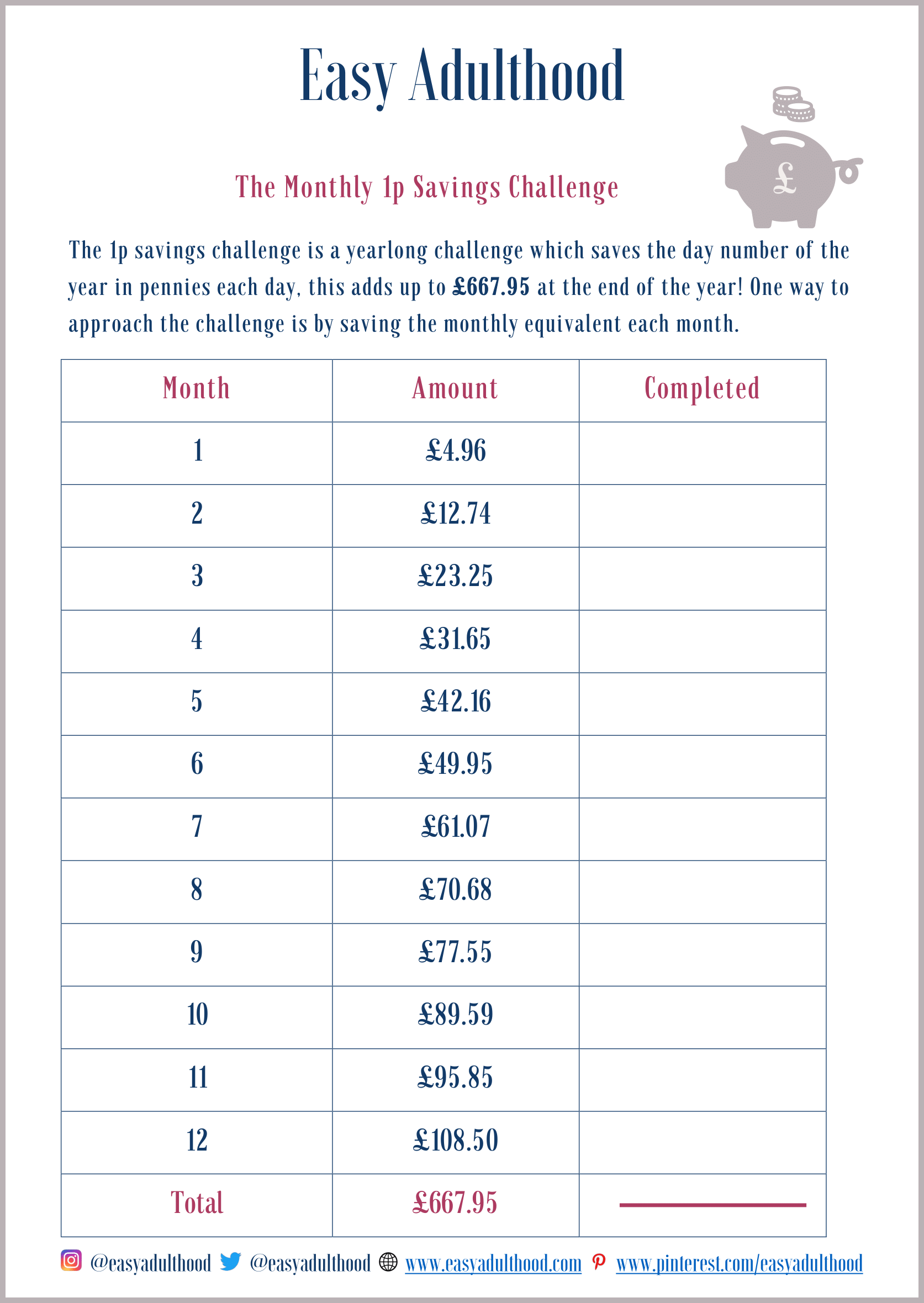

1. Save the monthly equivalent each month

The monthly equivalent approach sums up the amount that needs to be saved each month. This is useful if you get paid monthly and would like to put the money aside on payday. It’s also less arduous than transferring the daily amount.

If you want to save the monthly equivalent each month, you can download our free monthly penny savings challenge PDF, interactive Spreadsheet or interactive Google Sheet to track your progress.

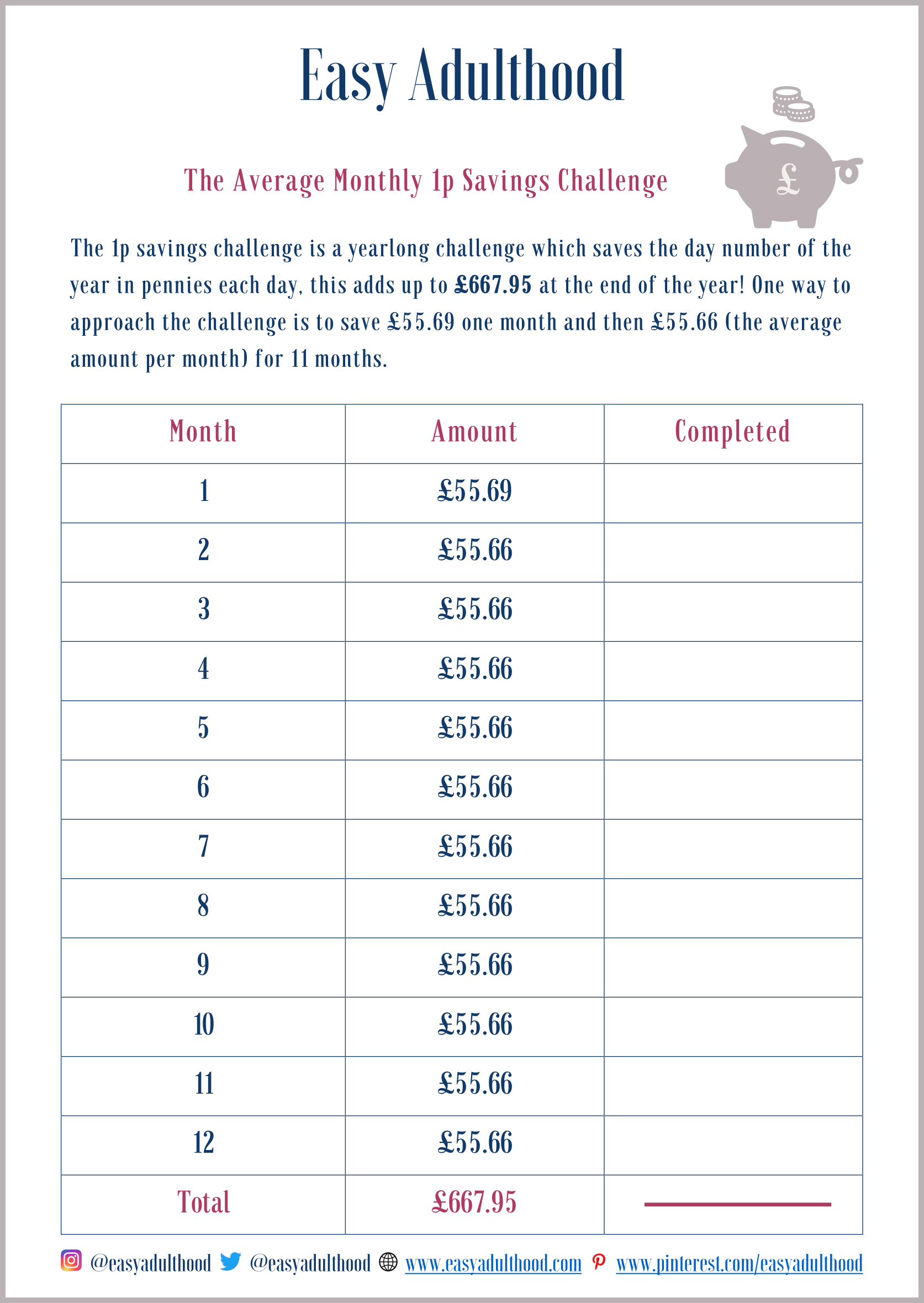

2. Save the average amount per month each month

The average amount per month approach averages the total amount for the year by the 12 months in the year. This is useful if you get paid monthly and don’t want large fluctuations in the amount you’re saving each month.

If you want to save the average amount per month each month, you can download our free average monthly penny savings challenge PDF, interactive Spreadsheet or interactive Google Sheet to track of your progress.

3. Save the weekly equivalent each week

The weekly equivalent approach sums up the amount that needs to be saved each week. This is useful if you get paid weekly and would like to put the money aside on payday.

If you want to save the weekly equivalent each week, you can download our free weekly penny savings challenge PDF, interactive Spreadsheet or interactive Google Sheet to keep track of your progress.

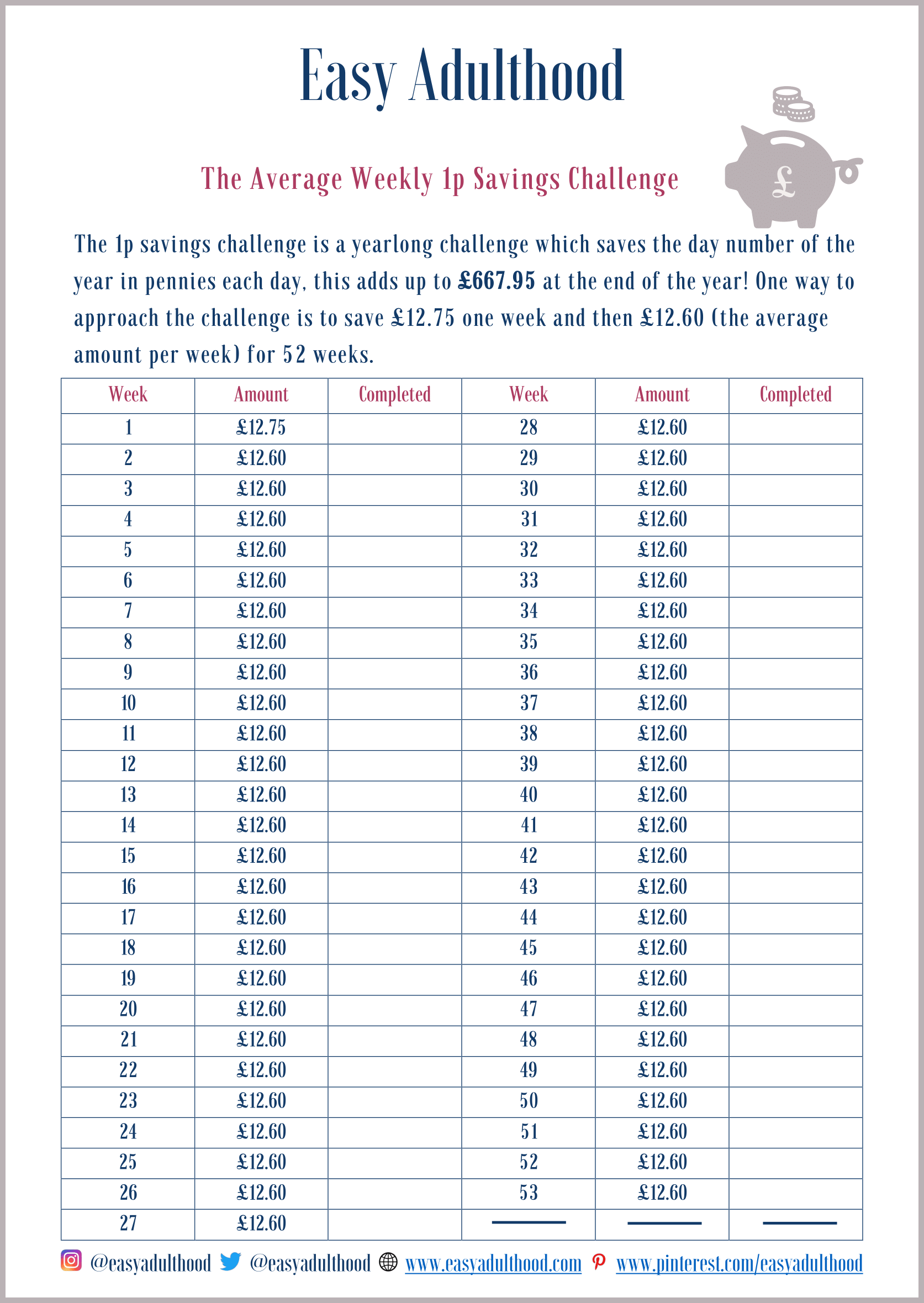

4. Save the average amount per week each week

The average amount per week approach averages the total amount for the year by the 52.14 weeks in the year. This is useful if you get paid weekly and don’t want large fluctuations in the amount you’re saving each week.

If you want to save the average amount per week each week, you can download our free average weekly penny savings challenge PDF, interactive Spreadsheet or interactive Google Sheet to keep track of your progress.

5. Save the day number of the year in pennies each day

Saving the day number of the year in pennies is a tremendous task in self-discipline and mental resilience, although this is the best known approach to the penny savings challenge.

If you want to save the day number of the year in pennies each day, you can download our free daily penny savings challenge PDF, interactive Spreadsheet or interactive Google Sheet to keep track of your progress.

6. Save the average amount per day each day

The average amount per day approach averages the total amount for the year by the 365 days in the year. This approach is good if you want to save the same amount each day.

If you want to save the average amount per day each day, you can download our free average daily penny savings challenge PDF, interactive Spreadsheet or interactive Google Sheet to keep track of your progress.

Our tips and tricks for completing the penny savings challenge

Determine which approach works for you

If you prefer to keep your savings in physical cash, it’s worth investing in a piggy bank for the challenge. If you find manually transferring money to be laborious, choose one of the average amount approaches and automate your savings by setting up a standing order.

If you bank with Monzo you can link the IFTTT app (If This Then That) to your Monzo account. You can use the 1p Savings Challenge on the IFTTT app to automate the penny savings challenge. The corresponding penny amount for the day of the year will be transferred to your Monzo pot every day.

Remember your why

Remind yourself why you are participating in the challenge, when you keep your goal in mind it’s easier to persevere.

Separate this money from your everyday spending

One of the best budgeting tips ever is to keep separate accounts for different purposes. The level of separation allows you to take control of your finances. If your bank allows you to create money pots, create a separate pot for the Penny Savings challenge. You can also place the money in an easy access or a regular savers account so it earns interest over the year.

Will you be taking part in the Penny Savings Challenge? Let us know in the comments below.